Singlife Whole Life Choice is the latest whole life plan by Singlife that is launched in Nov 2024 as their commitment to offer protection plans that grows and adapt to each individual needs. We explore what are the key features of Singlife Whole Life Choice that makes it one of the best whole life plan in Singapore today.

- Singlife Whole Life Choice offers Additional cover of 100%/200%/300%/400% on top of the base sum assured (ie; 2-5x multiplier)

- Singlife Whole Life Choice offers Additional cover till age 65/70/75/80/85 years old

- Gradual reduction of Additional cover of 12.5% each year for next 8 years after the Additional cover age

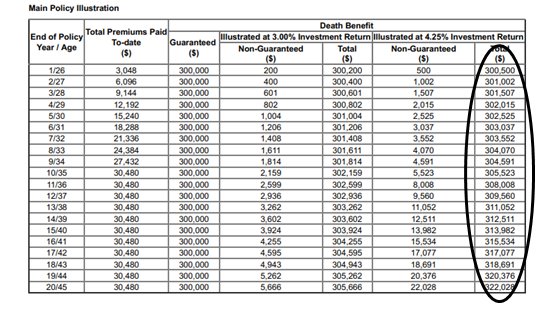

- Singlife Whole Life Choice pays the guaranteed sum assured (Base + Additional cover) together with the non-guaranteed bonus

* Multiplier Benefit is the guaranteed sum assured amount the insured will receive upon Death/TI/TPD/Critical illness (all stages) claim

Early Critical illness Advance Cover VI provides coverage against Early, Intermediate and Advanced Stages of Critical Illness. It also pays additional 20% of sum assured for Special benefits, Intensive Care Benefit and Benign and Borderline Malignant Tumour Benefit.

- ICU benefit: If the Life Assured is admitted to the Intensive Care Unit (ICU) due to an illness or Accident, upon ICU stay of 4 days or more in one hospital admission for Necessary Medical Treatment, an additional 20% of the Base Sum Assured of this Supplementary Benefit will be payable, subject to a maximum amount of S$25,000 per life.

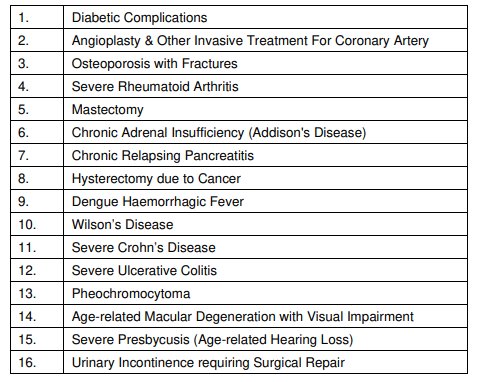

- Special Benefits: If the Life Assured is diagnosed with any one of the conditions listed below, an additional 20% of the Base Sum Assured of this Supplementary Benefit will be payable, subject to a maximum amount of S$25,000 per life per condition.

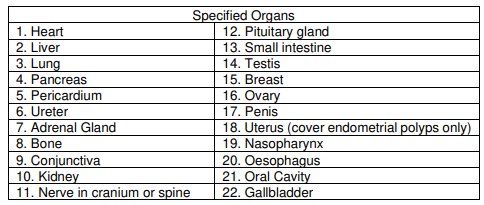

- Benign and Borderline Malignant tumour benefit: If the Life Assured undergoes a complete surgical excision of a Benign Tumour (suspected malignancy) requiring surgical excision from any of the covered Specified Organs or is diagnosed with a Borderline Malignant Tumour, an additional 20% of the Base Sum Assured of this Supplementary Benefit will be payable, subject to a maximum amount of S$25,000 per life

The policyholder has the option to purchase a new non-participating level term plan without evidence of insurability when one of the following significant life stage events occur:

1. Change of marital status

2. Becoming a parent

3. Purchase a property

4. Child enrols into tertiary education

5. Enters full time employment within one year from tertiary graduation

At life stage events, you can apply to withdraw the accumulated bonus without surrender charge. The life stage events include:

1. Change of marital status

2. Becoming a parent

3. Purchase a property

4. Child enrols into tertiary education

You can choose to exercise this option to receive monthly income up to a period of 20 years. You may utilise up to 80% of guaranteed cash value.

Singlife will waive the instalment premiums for 12 months if the policyholder has been retrenched or unemployed and remain involuntarily unemployed for 3 consecutive months.

These 6 features of Singlife Whole Life Choice make it one of the more competitive whole life plans in the Singapore. Chat with us to find out more!

ertertyt ytr yty tryrtsy rt yrt ysrtysrt aer y