Fundsmith Equity Fund has been a favored investment option for many investors in recent years and gained a loyal following due to their stellar outperformance of the MSCI world index since their inception in 2010.

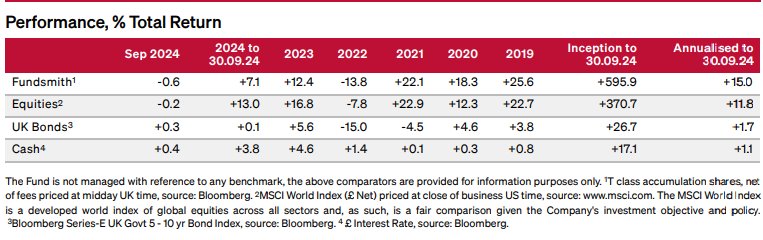

However, for years in 2021, 2022, 2023 and 2024 (YTD in Sep), Fundsmith Equity Fund has underperform its benchmark. So the question remains, is Fundsmith Equity Fund still a worthwhile investment?

In the annual letter by Terry smith back in July 2024, he rationalized that the 17% returns in the S&P 500 index were driven mainly by just 5 companies – Amazon, Apple, Meta, Microsoft and Nvidia. These 5 companies were responsible for 46% of the returns, of which 25% of the returns came from Nvidia alone.

While Fundsmith Equity Fund own three of these companies – Apple, Meta & Microsoft, underperformance of the broader index was expected as they do not own any Nvidia.

Terry Smith is not convinced that the outlook for Nvidia as the winner in AI, is as predictable as what the market have foreseen in such early years of Artificial Intelligence (See Yahoo in search, Blackperry in Smartphones, Cisco in cyberspace etc). As such, Terry Smith reluctance to invest in such high-flying tech stocks due to concerns about valuation and speculative fervor has led to underperformance to relative benchmarks that have embraced these trends.

Eveillard, born in 1940 in French city of Poitiers, was a value investor much like Benjamin Graham who truly believes in the investment motto – Margin of Safety. Graham’s explanation of margin of safety is buying stocks and bonds at favorable discount to their appraised value.

Eveillard’s investment strategy worked and he earned a reputation for high returns with low risks as a fund manager of SoGen international Fund. Business week and Morningstar feted him. His focus on valuation kept his shareholders safe in 1980s when he exited Japan entirely in 1988 as he couldn’t find a Japanese stock to meet his valuation requirements. By 1989, Japan accounted for 45% of the world’s stock market capitalization. The Japan bubble burst in 1989, and Japanese stocks feel into decades long spiral.

However, Eveillard’s reputation started weigh down in 1997 when the tech-heavy Nasdaq rose 290% from Jan 1997 to March 2000 (dot com bubble). Eveillard kept to his value investing principles, and refused to invest into the dot com mania.

On hindsight, it was not a hard decision. But back then, it took real conviction for fund managers to diverge from the crowd. As a result of his extreme position to invest in any technology companies in 1997 – 2000, he lagged the market for 3 long years so much so that his shareholders were upset with him. The Nasdaq gained +39.6% in 1998, +85.6% in 1999 during the dotcom bubble compared to his fund performance of -0.3% and +19.6%, and his fund dwindled from $6billion to $2billion due to loss of clients. Pressure from his bosses and board of the fund were palpable. Eveillard became an investment relic who didn’t understand the innovations of the New tech economy.

But as we all know, in March 2000, the tech bubble burst. Eveillard’s portfolio went on to beat the Nasdaq by 49% in 2000, 31% in 2001, and 42% in 2002. He was anointed Stock Fund manager in 2001 and Morningstar’s Lifetime achievement award in 2003.

The lesson of Eveillard highlights that investors are fickle-minded. One year you can be a fossil and a fool, the next you can be a sage. No matter how successful you are over decades, it highlights how difficult it is to build sustainable success.

In their investor’s manual, it states:

Fundsmith is focused on delivering superior investment performance at a reasonable cost. It was established to be different from its peers so as to achieve a different result in line with Sir John Templeton’s axiom that “If you want to have a better performance than the crowd, you must do things differently from the crowd.”

While some may view Fundsmith’s investment decisions to be a misstep (see Morningstar downgrade of Fundsmith Equity Fund), it highlights the tension between adhering to a disciplined investment philosophy and responding to market trends.

Like Eveillard, Terry Smith and his team long term investing principles that has historically proven sound for them and given his Fundsmith Equity fund +15% p.a since 2010. Only time will tell if Fundsmith Equity fund will return to outperforming the MSCI World index, in a challenging market that is increasingly driven by potential of Artificial Intelligence thesis.

(This article was written in 11th Oct 2024).

Disclaimer: This article is written in as opinion, and does not constitute as financial advice.

ertertyt ytr yty tryrtsy rt yrt ysrtysrt aer y