Maternity insurance offers benefits such as pregnancy complications and congenital illness. More importantly, it establishes a foundation for securing your child’s future insurability, regardless of pre-existing medical conditions at birth.

With that in mind, we will explain why HSBC HappyMummy (EmpoweredMum) is one of the best maternity insurance in Singapore.

HSBC Life HappyMummy is a bundled product consisting of both

i) HSBC Life EmpoweredMum; and

ii) HSBC Life – Life Treasure II or HSBC Life Flexi Protector

HSBC Life EmpoweredMum is a single premium non-participating term insurance that provides financial protection for an expectant Mother and her new-born Child of her current pregnancy.

1) Death coverage: 100% of sum assured

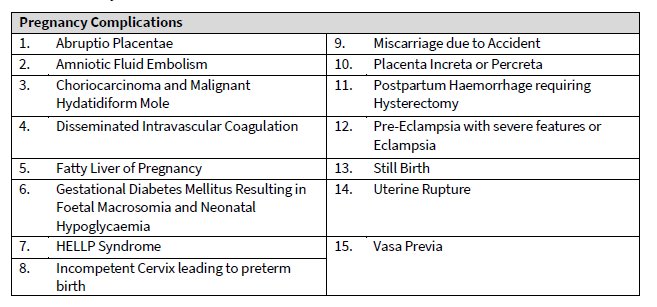

2) Pregnancy complications: 100% of sum assured

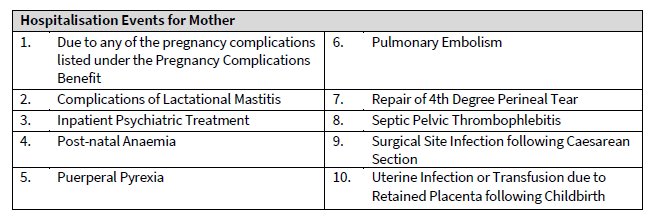

3) Hospital Care for the mother: 2% of the Sum Assured for each day of hospitalisation, up to 60% of the Sum Assured

4) Early Delivery by Caesarean Section – 1st in market

Receive 15% of the Sum Assured is payable if the expectant mother have undergone a delivery at less than thirty-six (36) weeks of gestation by caesarean section.

*The indication and procedure must be deemed Medically Necessary as certified by the treating doctor.

1) Death coverage: 100% of sum assured

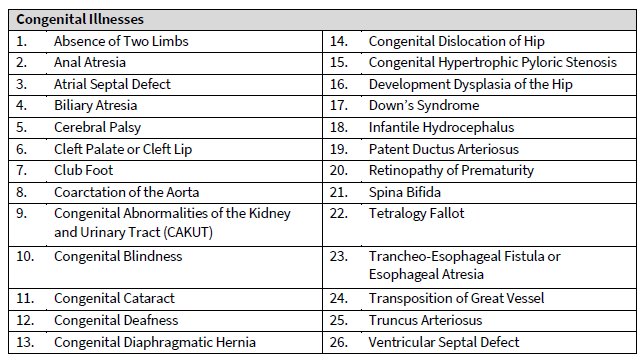

2) Congenital Illness 100% of sum assured

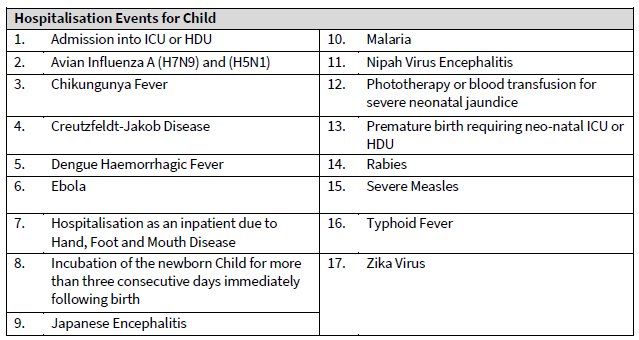

3) Hospital Care for the newborn child: 2% of the Sum Assured for each day of hospitalisation, up to 60% of the Sum Assured

4) Development Delay: 15% of the Sum Assured, capped at SGD 3,000 is payable once

If your newborn child is diagnosed with developmental delay in gross motor or speech development during the period from your child’s attained age of twenty-eight (28) months to the Policy Expiry Date, HSBC Life will pay 15% of the Sum Assured capped at SGD 3,000.

HSBC HappyMummy provides a foundation in ensuring your child’s future insurability, regardless of pre-existing medical conditions at birth.

- Within 60 days of birth of child, you can opt to transfer the cover of Life Treasure II and its riders to your new born child, without any medical underwriting.

- Within 60 days of birth of child, you can opt to transfer the cover of HSBC Life Flexi Protector and its riders to your new born child, without any medical underwriting.

By allowing the transfer HSBC Life – Life Treasure II or HSBC Life Flexi Protector, it ensures that your child is covered for whole life against any Death/TPD and critical illness coverage.

Within 60 days of birth of your newborn child’s date of birth, you are eligible to apply for your newborn Child HSBC Life Shield Plan B without any medical underwriting and enjoy a free first year premium.

Under this offer, there is no underwriting for the HSBC Life Shield Plan B. If any rider is applied together with HSBC Life Shield Plan B, there is no underwriting for both the basic Policy and rider. This will ensure that your newborn will be adequately covered for any eligible medical expenses.

* For premature babies, the HSBC Life Shield Plan B Application can only be submitted on and within 60 days from Your expected due date, to enjoy the free first year premium on HSBC Life Shield Plan B without underwriting.

Looking to find out which maternity insurance is for you? Chat with our licensed financial advisor to recommend the best maternity insurance for you.

ertertyt ytr yty tryrtsy rt yrt ysrtysrt aer y