HSBC Life - Life Treasure (II) is a limited premium payment whole life participating policy which covers Death, Total and Permanent Disability and Terminal Illness. The plan provides a high level of whole life insurance protection with the multiplier benefit, and option to add supplementary riders for comprehensive protection.

In this review, we explore the salient features of HSBC Life - Life Treasure II that makes it one of the best whole life insurance plan in the market.

Multiplier Benefit is the guaranteed sum assured amount the insured will receive upon Death/TI/TPD/Critical illness (all stages) claim.

Multiplier benefit coverage till age: 65/70/80 years old.

Multiplier Factor: 2x/3x/4x/5x

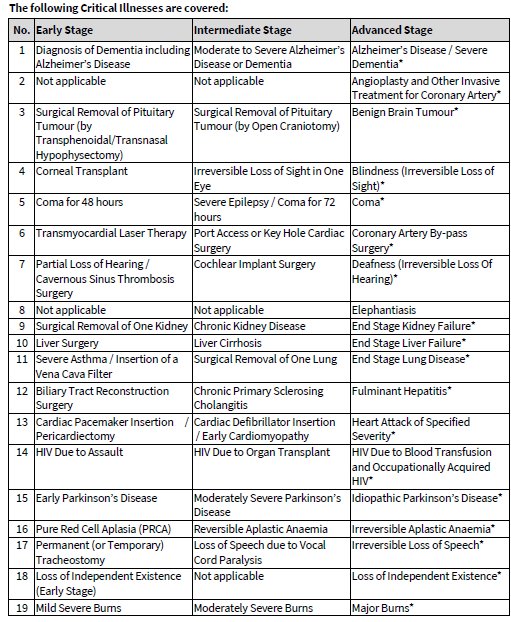

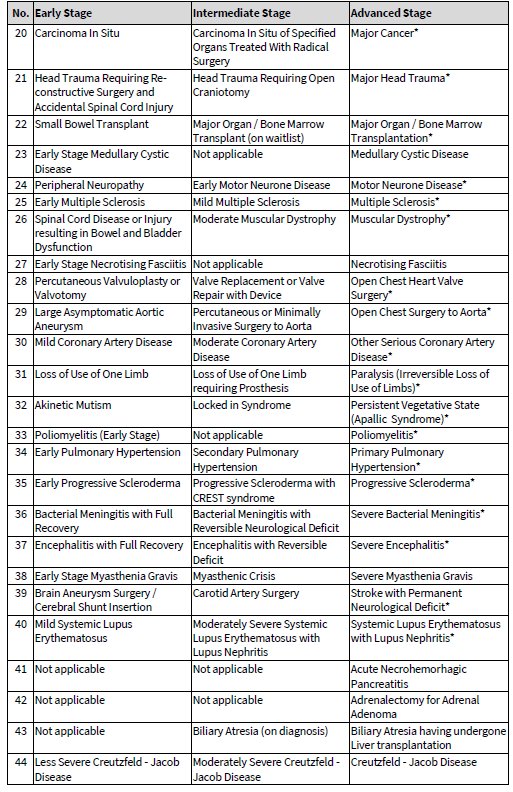

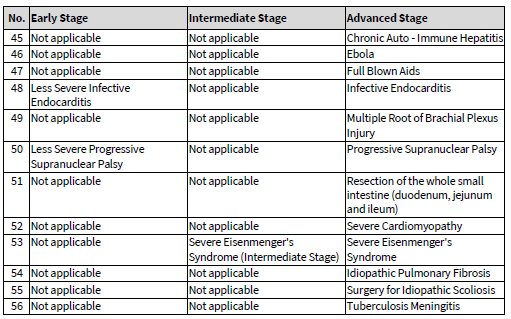

Critical Illness Benefit (II) rider provides financial protection against 56 Advanced Stages of Critical Illnesses (“CI”) and additional protection for Top Common Critical Illnesses (5).

Type of Advanced Stage Critical illness

Top Common Critical illness Benefit

Under the Top Common Critical Illness Benefit, if the insured is diagnosed with any of the Top Common Critical Illness, HSBC Life will pay an additional amount equal to 50% of the original Sum Assured of this Rider.

List of advanced stage Top Common Critical Illness:

1. Major Cancer

2. Heart Attack of Specified Severity

3. Stroke with Permanent Neurological Deficit

4. Coronary Artery By-pass Surgery

5. End Stage Kidney Failure

Early Critical Illness Benefit (II) Rider provides financial protection against Early, Intermediate and Advanced Stages of Critical Illness (“CI”). It also comes with additional protection for Top Common Critical Illnesses and selected Special Conditions and Juvenile Conditions.

Type of Critical illness

Top Common Critical Illness Benefit

Under the Top Common Critical Illness Benefit, if the insured is diagnosed with any of the Top Common Critical Illness, HSBC Life will pay an additional amount equal to 50% of the original Sum Assured of this Rider.

List of advanced stage Top Common Critical Illness

1. Major Cancer

2. Heart Attack of Specified Severity

3. Stroke with Permanent Neurological Deficit

4. Coronary Artery By-pass Surgery

5. End Stage Kidney Failure

Special Benefits

Under Special benefits, if the insured is diagnosed with any of the Special Conditions listed below, HSBC Life will pay an additional amount equal to 10% of the original Sum Assured of this Rider, subject to a maximum of $25,000 per Life Assured per Special Condition

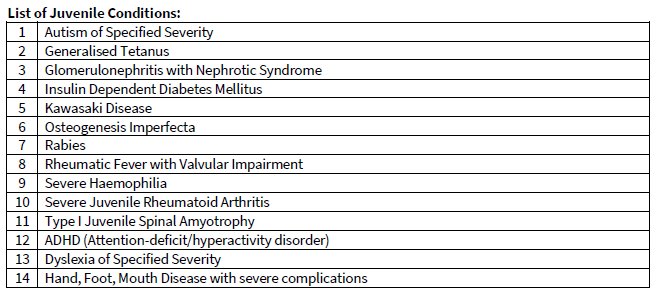

Juvenile Conditions Benefit

Under Juvenile Conditions Benefit, if the insured is below attained age 18 and is diagnosed with any of the Juvenile Conditions listed below, HSBC Life will pay an additional amount equal to 10% of the original Sum Assured of this Rider, subject to a maximum of $25,000 per Life Assured per Juvenile Condition.

The policyholder has the option to purchase a new GIO whole life, term or investment-linked Policy covering Death, TI, TPD and/or Critical Illness (“CI”), without providing evidence of health when one of the following significant life stage events occur:

1. the Life Assured’s legal marriage/ divorce; or

2. the Life Assured has a new born baby; or

3. the Life Assured has adopted a child through legal means; or

4. the Life Assured has completed a purchase of a property in Singapore; or

5. the Life Assured’s child entering primary school or secondary school or university; or

6. the Life Assured enters first full-time employment after graduation; or

7. the Death of the Life Assured’s spouse

These 4 features of HSBC LIFE – Life Treasure II make it one of the most popular whole life plans in the market. Chat with us to find out more!

ertertyt ytr yty tryrtsy rt yrt ysrtysrt aer y