Home ownership is one of the key milestones in one’s life. If you are purchasing a HDB and are using CPF savings to pay for monthly loan installments, it is mandatory to purchase CPF Home Protection Scheme (HPS).

HPS is a mortgage-reducing term insurance that sole purpose is to provide protection for you and your family from losing your HDB flat in the unfortunate event of death, Terminal Illness (TI) or total permanent disability (TPD). The sum assured paid for HPS, in the event of Death, TI or TPD will go towards paying the existing housing loan.

By doing so, your family can have a peace of mind and do not have to worry about the burden of managing the loan repayments and potential risk of losing the flat.

1. Reducing Sum assured: The sum assured will decrease yearly as the homeowner pays off the loan. However, the premium will remain the same throughout the policy term.

2. Payment: Premium is kept affordable, and is deducted from your CPF-OA savings annually. Premium payment term is only 90% of the HPS cover period.

3. Policy Term: HPS will cover the homeowner until the age of 65, or until the housing loan is fully paid, whichever is earlier.

4. HPS ‘Premium Rate’: The mortgage reducing sum assured will be based on HDB Loan at 2.6%

5. HPS Exemption: Option to opt out of HPS if you have your own existing life or term insurance that is able to cover for the housing loan amount.

If you are private home owner, HPS will not be eligible for you as it does not cover private housing (even if you are using your CPF to pay for home installments). Instead, you will have to get your own private life insurance as a form of mortgage insurance.

For HDB owners, one may also consider getting their own life insurance to cover for mortgage as it offers more flexibility in terms of the sum assured, policy term, and option to include critical illness coverage. Additionally, you can also use the same life insurance to cover for future home purchase, whereas HPS will end if you sell your flat, or have a full redemption of HDB loan.

1. Term Insurance

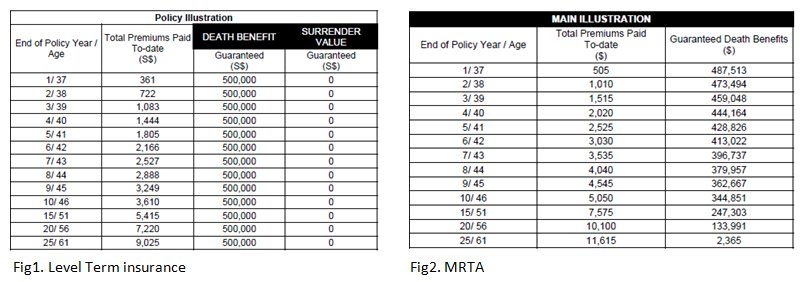

Term insurance (Eg, Singlife Elite Term, Etiqa Essential Term life Cover) is the preferred option when covering for mortgage loan as it offers a level sum assured coverage, offers the option to include early critical illness coverage.

Additionally, the premium can be more affordable as compared to MRTA.

2. Mortgage Reducing Term Assurance (MRTA)

Mortgage Reducing Term Assurance offers similar coverage as HPS whereby the sum assured will decrease over term and premium term is 90% of the policy term.

MRTA also offers interest rate options from 1-5% to ensure that your mortgage loan is adequately covered.

*Premium based on Male, Non smoker and quotation will defer between insurers and insured profile

*Premium based on Male, Non smoker and quotation will defer between insurers and insured profile

With Level Term insurance, we can see that the sum assured remains the same throughout the policy term. However, for MRTA, the sum assured will decrease yearly even as the premiums remains the same throughout the policy term.

Enquire with us now to receive the most competitive quotes for term insurance and mortgage insurance. Protect your loved ones and your home with the best coverage available.

ertertyt ytr yty tryrtsy rt yrt ysrtysrt aer y